Financial literacy is the ability to understand how money works: how someone makes, manages and invests it, and also expends it (especially when one donates to charity) to help others. …

-

LEARN MORE HERE: www.ladafinancialliteracy.online

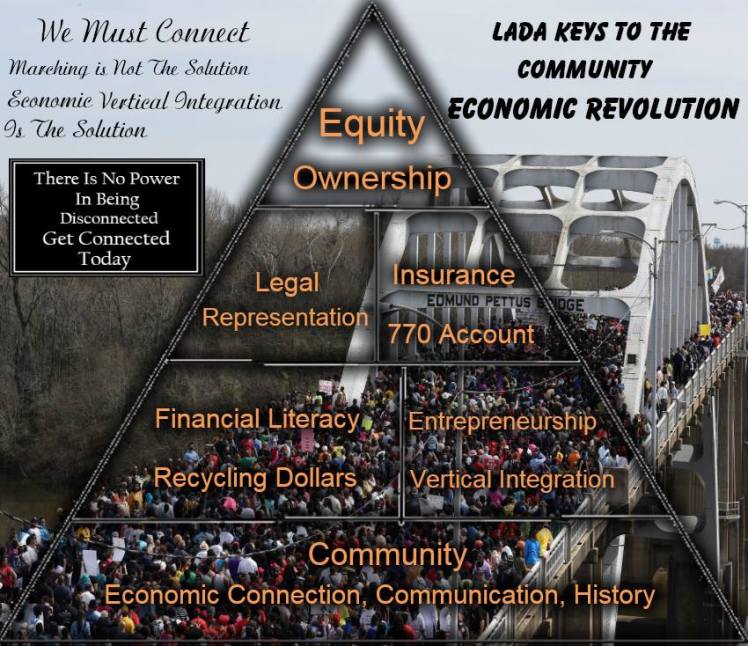

THE LADA GROUP FINANCIAL LITERACY TRAINING

CLICK HERE TO SEE OUR PRODUCTS

Click on Image below to See if You are an Entrepreneur or Employee

Financial literacy is arguably one of the most important skills someone can develop in today’s world (right next to traditional literacy and technological literacy). Basic finance touches nearly every part of a person’s life, and is a building block of some of the most important decisions people make: buying a car, buying a home, going to college, and saving for retirement are just some examples.

Benjamin Franklin once said: “An investment in knowledge pays the best interest.” We seem to have forgotten those wise words when it comes to personal finance. Financial literacy is the foundation of building wealth. If you fail to understand the role of money and how it works in the world, it’s virtually impossible to secure your financial future. Unfortunately, financial knowledge is absent in the education system.

The majority of Americans have not received a formal financial education. According to a new poll from MoneyRates.com, 64 percent of respondents say they received little or no financial education in high school. In fact, only 43 percent of men say they received some or a lot of financial education in high school, while just 29 percent of women report the same. Not receiving lessons about money in high school has damaging effects.

The majority of Americans have not received a formal financial education. According to a new poll from MoneyRates.com, 64 percent of respondents say they received little or no financial education in high school. In fact, only 43 percent of men say they received some or a lot of financial education in high school, while just 29 percent of women report the same. Not receiving lessons about money in high school has damaging effects.

Take the Financial Literacy Quiz

The LADA Groups Financial Literacy Training will cover the following areas:

What is a 770 Account?

Technology and E-payments

The Need to become an Entrepreneur

Purpose of Insurance

Purpose of Banks

Difference between a Financial Statement and Credit Report

Purpose of FDIC and What’s Covered

What is a Federal Reserve Note?

What is the U.S. Federal Reserve Bank?

Who owns The Federal Reserve?

Purpose of a Credit Union

What is a Safe Deposit Box?

What is Money?

How is Money Created?

What is Digital Money? (All the banks money is digital)

What is Electronic Money?

What is Bitcoin?

What is Electronic Currency Trading?

What is the Forex Market?

What’s a savings account?

What’s interest?

What’s a stock?

What’s a mutual fund?

What is an Asset?

What is a Liability?

What the US Constitution Says is Money

The Reason why the FEDS had JFK Killed Executive Order 11110

The Employee Retirement Income Security Act (ERISA) 401K

Financial Terms That Every Investor Show Know

So Let’s get started…….

THE LADA GROUP WILL SHOW YOU HOW TO

Today, we are caught up in a real life Monopoly Game playing with Fake Money. We are hoping to stay out of jail and don’t land on bankrupt. If you work a job today or get paid for your services through self employment and they give you a check or give you cash you lose because that is fake money. People with cash in their pockets are the losers today.

Technology today has change our outlook on money today. Banks hate paper money because the Banks money is Digital. Banks convert the federal reserve notes that you give them into gold because their money is digital and can be back by gold. You need to learn how to make digital money like the banks.

What is the purpose of the Infinite Banking Concept/770 Account?

At the end of the day, the Infinite Banking/770 Account strategy is about re-directing money that you would otherwise send to banks and instead put that cash flow back into your own private banking system. All families would benefit from putting their savings where it could grow uninterrupted for life instead of having to stop and start when life throws a curve ball. (In more simpler terms, this strategy is tax-favored savings account with a death benefit attached to it. I encourage you to think far beyond opening a 770 Account if you going to use just as a better savings account. Money in motion has far greater value than idle money. Hint: Think like a banker!)

Taking back the banking function you have given to your bank is a novel concept for everyone. Why? A lack of financial education has lead us to believe that banks are not only a safe place for money, but the source of financing to get us through life. Outside of a checking account, there is no reason you should ever deal with a bank!

One of the best long-term benefits of the 770 Account/IBC is the tax-free death benefit which can help improve a families wealth class from one generation to the next. Without this generational transfer, most families are left no better off than their previous generation. The short-term benefits are tax-favored contractual growth and liquidity. Everyone can and should have access to such benefits. Learn more click here

Today you must use an electronic form of payment. Credit card, Debit Card, Smart Phone or the Internet. You must also be able to accept electronic and digital payments through the use of Paypal, Square and other devices that will allow you to accept these payments. We are now living in the Cashless Society and if you’re still using cash you are behind times. We will show and teach you how to fully convert over to the cashless society where the banks, credit unions and investors have their money.

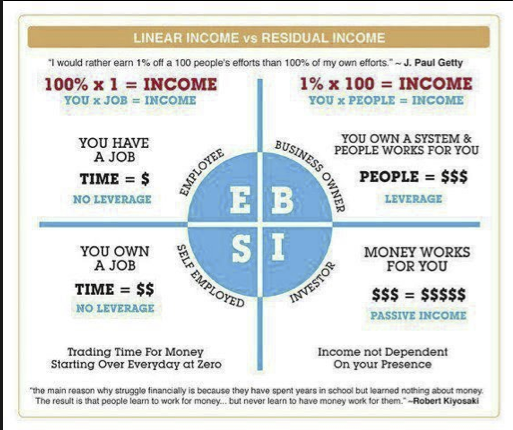

In today’s world everybody needs a business

First let me explain what a business is today. A Business is the Organization of Systems that will WORK FOR YOU whether you’re there or not. The only Tax write offs we have today is if you own property you can write off your property taxes and interest. If you own a business you can write off just about everything.

You don’t need a job or self employment which is a job that you own without a boss and can’t leverage. You need to learn how to create jobs and that’s what we’re going to teach you. Today, your mindset should be set on becoming a Business Owner and Investor. Let me show you what I’m talking about. What is a Cash Flow System? You are either working your own system or someone has you working in their system paying them $$. Wouldn’t you like to get paid on a weekly and monthly basis by people that you don’t even know?

1. In business as in personal finance, cash flows are essential to solvency. They can be presented as a record of something that has happened in the past, such as the sale of a particular product, or forecasted into the future, representing what a business or a person expects to take in and to spend. Cash flow is crucial to an entity’s survival. Having ample cash on hand will ensure that creditors, employees and others can be paid on time. If a business or person does not have enough cash to support its operations, it is said to be insolvent, and a likely candidate for bankruptcy should the insolvency continue.

1. In business as in personal finance, cash flows are essential to solvency. They can be presented as a record of something that has happened in the past, such as the sale of a particular product, or forecasted into the future, representing what a business or a person expects to take in and to spend. Cash flow is crucial to an entity’s survival. Having ample cash on hand will ensure that creditors, employees and others can be paid on time. If a business or person does not have enough cash to support its operations, it is said to be insolvent, and a likely candidate for bankruptcy should the insolvency continue.

2. The statement of a business’s cash flows is often used by analysts to gauge financial performance. Companies with ample cash on hand are able to invest the cash back into the business in order to generate more cash and profit.

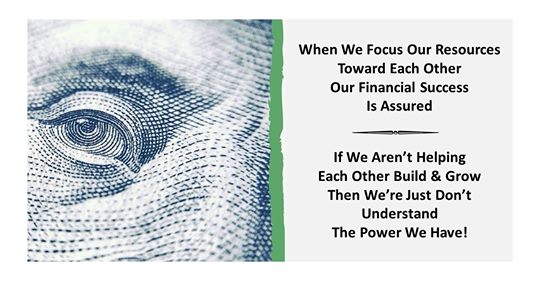

The LADA Group is calling an Audible to the way you think about making money and building wealth for generation. Stop working for Money because it will Work for you if you put it in the proper system that uses technology that will allow you to work with others. Like a Football team. You’re going to need a team of like minded individuals to win the game. Everybody plays a different position in the game but have certain responsibilities. In life it’s the same way we are all different but have the responsibility to come together with others in order to live a better life by helping one another. Remember T.E.A.M means Together Everyone Accomplishes More.

What is an Audible? [aw-duh-buh

1.capable of being heard; loud enough to be heard; actually heard.

2.Also called automatic, check off. Football. a play called at the line of scrimmage to supersede the play originally agreed upon as the result of a change in strategy.

This what you have to do in life. If you’re not where you want to be you have to do something totally different. If you keep doing the same thing you doing now you not going to get there. Step outside the Box.

Life is like a Football game. Its based on 4 quarters

The first 25 years on your life you are preparing to play the Game of Life. Getting your education to play the game. The one thing that they don’t teach you is how to score a Touchdown (Make Money). They just teach you the basics of the game how to block and tackle. In order to score you must have a play or strategy and Today with Technology all that has changed the game. Changes can happen instantly but Nobody says its going to be easy.

The Kickoff starts the game at Age 25-35 its the first quarter of your life.

Age 35-45 is the second quarter and then it’s half-time. This is where you really take a look at your life again to see if you’re at the place you planned to be. What adjustments do you make before the second half. Now the second half kickoff is from Age 45-55 and the fourth quarter its 55-65. What is the score? Can you retire and really enjoy the game of life or do you have to go into overtime and sudden death. Well The Lada Group has an Audible for you to Insure you win the game.

Comes from football, seen when the quarterback goes up to the line of scrimmage, sees a defensive alignment he wasn’t expecting, and adjusts by yelling out a new play. I’m thinking of going jogging but if it rains I’ll have to call an audible and go to the gym instead.

Now its time to learn the purpose and definition of everything you’re going to need to know in order to succeed.

Do You Really Know The Purpose of Insurance?

A promise of compensation for specific potential future losses in exchange for a periodic payment. Insurance is designed to protect the financial well-being of an individual, company or other entity in the case of unexpected loss. Some forms of insurance are required by law, while others are optional. Agreeing to the terms of an insurance policy creates a contract between the insured and the insurer. In exchange for payments from the insured (called premiums), the insurer agrees to pay the policy holder a sum of money upon the occurrence of a specific event. In most cases, the policy holder pays part of the loss (called the deductible), and the insurer pays the rest. Examples include car insurance, health insurance, disability insurance, life insurance, and business insurance.

You can also insure your money by taking the Federal Reserve Notes that you were going to put in the bank and take them to a Good Coin Shop and purchase some Gold and Silver of the same value and then put them in a safe deposit box that’s not associated with a bank like the San Diego Vault located in mission valley.

Insurance is NOT a Good Investment Vehicle. Use Insurance to protect your own valuables and assets. Insurance companies pay very little interest like the banks do now. They take Your Money and Use it for their Purpose. Now is time to take Your Money and Use it for your own purposes and Benefit. Go Downtown in Any City and see what the tallest buildings are. Either a Bank or Insurance Company and they built those buildings with Your Money by promising you to pay you in the Future while they make Right Now Money because you pay them MONTHLY. You can earn Right Now Money with The Lada Group Economic System.

Purpose of Banks

A Bank is a financial institution which is involved in borrowing and lending money. Banks take customer deposits in return for paying customers an annual interest payment. The bank then use the majority of these deposits to lend to other customers for a variety of loans. The difference between the two interest rates is effectively the profit margin for banks. Banks play an important role in the economy for offering a service for people wishing to save. Banks also play an important role in offering finance to businesses who wish to invest and expand. These loans and business investment are important for enabling economic growth.

(Note: Banks are not a good place to save money because what you are saving is not worth anything more. You’re trying to save Federal Reserve Notes which are IOU’s Owned by the banks. Just by recycling dollars back into your own community use a system design to do so, you would not have to ask the banks for a loan. Banks don’t lend money on ideas. They lend money for collateral so what do you OWN that’s worth something that they want.)

You need to have a Financial Statement when dealing with Banks and Investors. Here is the difference between a financial statement and credit report.

You need to have a Financial Statement when dealing with Banks and Investors. Here is the difference between a financial statement and credit report.

Definition of ‘Financial Statements’

Records that outline the financial activities of a business, an individual or any other entity. Financial statements are meant to present the financial information of the entity in question as clearly and concisely as possible for both the entity and for readers. Financial statements for businesses usually include: income statements, balance sheet, statements of retained earnings and cash flows, as well as other possible statements.

It is a standard practice for businesses to present financial statements that adhere to generally accepted accounting principles (GAAP), to maintain continuity of information and presentation across international borders. As well, financial statements are often audited by government agencies, accountants, firms, etc. to ensure accuracy and for tax, financing or investing purposes. Financial statements are integral to ensuring accurate and honest accounting for businesses and individuals alike.

Definition of ‘Credit Report’

A detailed report of an individual’s credit history prepared by a credit bureau and used by a lender to in determining a loan applicant’s creditworthiness, including:

A detailed report of an individual’s credit history prepared by a credit bureau and used by a lender to in determining a loan applicant’s creditworthiness, including:

1. Personal data (current and previous addresses, social security number, employment history)

2. Summary of credit history (number and type of accounts that are past-due or in good standing)

3. Detailed account information

4. Inquires into applicant’s credit history (number and type of inquiries into applicant’s credit report)

5. Details of any accounts turned over to credit agency (such as information about liens, wages garnishments via federal, state or county records)

6. Information on how to dispute any of the above information.

Once negative information appears on your credit report, there is little you can do to clear it up if the information is truthful and accurate. Generally such information remains for about seven years, while bankruptcy filings typically stay on the credit report for about 10 years.

What Is FDIC Insurance?

FDIC insurance refers to insurance policies created by the Federal Deposit Insurance Corporation, which is an organization wholly run by the government of the United States.

The FDIC sells insurance policies to banks which insures the checking and savings accounts at those banks against the failure of those banks. Thus, when you open an account with a bank, that bank purchases insurance on that account for you from the FDIC.

The FDIC was established back in 1933 when we had Silver and Gold Certificates which was real money. You could receive real silver and gold for your certificates. The Feds didn’t want this because they knew they didn’t have enough gold and silver in the banks to cover all the certificates they had issued. This was done to stop a run on the banks that happen by in 1929 during the great depression. Today’s Federal Reserve Notes aka Fiat Currency is not with anything because its not attached to anything so they wouldn’t have this problem any more. You have to convert your fiat currency back into real money which is gold and silver.

(Note: You cannot Insure something that you don’t own. The United States Government is insuring Federal Reserve Notes which are IOU’s. Federal Reserve Notes belong to the Federal Reserve System. The Federal Reserve is the Central Banking System that we’re all apart of and The Government Has No Control Over Them. The FEDS control the worlds money.)

FDIC insurance covers checking accounts, savings accounts, certificates of deposit, money market accounts, and cashier’s checks. It does not cover stocks, bonds, mutual funds, money market accounts, US treasuries, safe deposit box contents, or other such items. These are things that can be back with real money like gold and silver.

Do Not Put any of your important documents or money in a banks safe deposit box. You get a Safe Deposit Box that’s not at the bank. The San Diego Vault located in Mission Valley is the best place.

Look at what the FDIC covers. What’s in those accounts? FEDERAL RESERVE NOTES. Federal Reserve Notes belongs to them and they have them already so they don’t owe you anything because you didn’t convert any of federal reserve notes into real money which is Gold and Silver. Silver to the Best Investment Right Now and its affordable. It’s all about ownership. Did you own any gold and silver? The FEDS have a vault full of it.

Most banks that operate in the United States buy this insurance. When they do, they’re required to display the FDIC logo on signs in their business as well as on their websites.

FDIC insurance insures deposits up to $250,000 per depositor. This means that if your bank fails, the first $250,000 in your account is insured by the FDIC and will be returned to you in the event of a bank failure.

A Federal Reserve Note is not money. It is debt according to the Banks. Its an IOU with the terms for repayment on the NOTE. So if you have $250,000 of Federal Reserve Notes in the bank you are not going to get anything because you don’t have anything but a piece of paper. The Federal Reserve owns the note.

What is the purpose of the Federal Reserve System?

The Federal Reserve System, often referred to as the Federal Reserve or simply “the Fed,” is the central bank of the United States. It was created by the Congress to provide the nation with a safer, more flexible, and more stable monetary and financial system. The Federal Reserve was created on December 23, 1913, when President Woodrow Wilson signed the Federal Reserve Act into law. Today, the Federal Reserve’s responsibilities fall into four general areas.

Conducting the nation’s monetary policy by influencing money and credit conditions in the economy in pursuit of full employment and stable prices.

Supervising and regulating banks and other important financial institutions to ensure the safety and soundness of the nation’s banking and financial system and to protect the credit rights of consumers.

Maintaining the stability of the financial system and containing systemic risk that may arise in financial markets.

Providing certain financial services to the U.S. government, U.S. financial institutions, and foreign official institutions, and playing a major role in operating and overseeing the nation’s payments systems.

Who owns the Federal Reserve?

The Federal Reserve System fulfills its public mission as an independent entity within government. It is not “owned” by anyone and is not a private, profit-making institution.

As the nation’s central bank, the Federal Reserve derives its authority from the Congress of the United States. It is considered an independent central bank because its monetary policy decisions do not have to be approved by the President or anyone else in the executive or legislative branches of government, it does not receive funding (because we willing give them our money for them to use) appropriated by the Congress, and the terms of the members of the Board of Governors span multiple presidential and congressional terms.

However, the Federal Reserve is subject to oversight by the Congress, which often reviews the Federal Reserve’s activities and can alter its responsibilities by statute. Therefore, the Federal Reserve can be more accurately described as “independent within the government” rather than “independent of government.”

The 12 regional Federal Reserve Banks, which were established by the Congress as the operating arms of the nation’s central banking system, are organized similarly to private corporations–possibly leading to some confusion about “ownership.” For example, the Reserve Banks issue shares of stock to member banks. However, owning Reserve Bank stock is quite different from owning stock in a private company. The Reserve Banks are not operated for profit, and ownership of a certain amount of stock is, by law, a condition of membership in the System. The stock may not be sold, traded, or pledged as security for a loan; dividends are, by law, 6 percent per year.

Definition of ‘Federal Reserve Note’

The most accurate term used to describe the paper currency (dollar bills) circulated in the United States. These Federal Reserve Notes are printed by the U.S. Treasury at the instruction of the Federal Reserve member banks, who also act as the clearinghouse for local banks that need to increase or reduce their supply of cash on hand. This term is often confused with Federal Reserve Bank Notes, which were issued and redeemable only by each individual member bank, but phased out in the mid-1930s.

Definition of ‘Credit Union’

Member-owned financial co-operative. These institutions are created and operated by its members and profits are shared amongst the owners.

As soon as you deposit funds into a credit union account, you become a partial owner and participate in the union’s profitability. Credit unions are formed by large corporations and organizations for their employees and members.

How is a Credit Union Different than a Bank?

In the United States, credit unions are not-for-profit organizations that exist to serve their members rather than to maximize corporate profits. Like banks, credit unions accept deposits and make loans. But as member-owned institutions, credit unions focus on providing a safe place to save and borrow at reasonable rates. Unlike banks, credit unions return surplus income to their members in the form of dividends.

Favorable Rates and Customer Service Fees and loan rates at credit unions are generally lower, while interest rates returned are generally higher, than banks and other for-profit institutions. Credit unions are democratically operated by members, allowing account holders an equal say in how the credit union is operated, regardless of how much they have invested in the credit union.

Membership Access

Each institution decides who it will serve. In order to join a credit union, potential members must be part of a field of membership, which is typically based on one’s employment, community, or membership in an association or organization. Credit unions serve members of modest means. Low-income credit unions provide financial services at reasonable rates in areas that are often underserved by banks.

NCUA Share Insurance Coverage

Federally insured credit unions are regulated by the National Credit Union Administration and backed by the full faith and credit of the United States government. The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 increased the share insurance coverage on all federally insured credit union accounts up to $250,000.

What is a Safe Deposit Box?

ABOUT BLUE VAULT SAN DIEGO

The highest security and privacy available, for protecting your valuables and keeping them confidential.

Store valuables in a Swiss-style private vault

Buy gold and silver bullion bars and coins

Use your IRA to buy and store gold or silver

Like a Fort Knox for the public, BlueVault is the center for anything valuable or important. Whether you’re storing personal or business property, buying or selling precious metals, or investing in a Gold IRA, there’s nothing like BlueVault anywhere.

San Diego’s Only Approved IRA Depository

At BlueVault you can use retirement funds to purchase precious metals bullion and store it close to home in San Diego’s only approved depository for IRA gold and silver. Unlike previously, you don’t have to send your bullion to a distant depository. Here at BlueVault it’s insured by Lloyd’s of London and protected 24/7 by a UL-certified security system. You can even see your assets in person, and be certain they’re really there. Learn more.

What Is Money?

Before the development of a medium of exchange, people would barter to obtain the goods and services they needed. This is basically how it worked: two individuals each possessing a commodity the other wanted or needed would enter into an agreement to trade their goods.

This early form of barter, however, does not provide the transferability and divisibility that makes trading efficient. For instance, if you have cows but need bananas, you must find someone who not only has bananas but also the desire for meat. What if you find someone who has the need for meat but no bananas and can only offer you bunnies? To get your meat, he or she must find someone who has bananas and wants bunnies …

The lack of transferability of bartering for goods, as you can see, is tiring, confusing and inefficient. But that is not where the problems end: even if you find someone with whom to trade meat for bananas, you may not think a bunch of them is worth a whole cow. You would then have to devise a way to divide your cow (a messy business) and determine how many bananas you are willing to take for certain parts of your cow. (It can be hard to talk about money with your children, especially when times are tough

To solve these problems came commodity money, which is a kind of currency based on the value of an underlying commodity. Colonialists, for example, used beaver pelts and dried corn as currency for transactions. These kinds of commodities were chosen for a number of reasons. They were widely desired and therefore valuable, but they were also durable, portable and easily stored.

Another example of commodity money is the U.S. currency before 1971, which was backed by gold. Foreign governments were able to take their U.S. currency and exchange it for gold with the U.S. Federal Reserve. If we think about this relationship between money and gold, we can gain some insight into how money gains its value: like the beaver pelts and dried corn, gold is valuable purely because people want it.

It is not necessarily useful – after all, you can’t eat it, and it won’t keep you warm at night, but the majority of people think it is beautiful, and they know others think it is beautiful. Gold is something you can safely believe is valuable. Before 1971, gold therefore served as a physical token of what is valuable based on people’s perception. (You don’t need an MBA to learn how to save money and invest in your future.

Impressions Create Everything

The second type of money is fiat money, which does away with the need to represent a physical commodity and takes on its worth the same way gold did: by means of people’s perception and faith. Fiat money was introduced because gold is a scarce resource and economies growing quickly couldn’t always mine enough gold to back their money requirement. For a booming economy, the need for gold to give money value is extremely inefficient, especially when, as we already established, value is really created through people’s perception.

Fiat money

Fiat Currency becomes the token of people’s apprehension of worth – the basis for why money is created. An economy that is growing is apparently doing a good job of producing other things that are valuable to itself and to other economies. Generally, the stronger the economy, the stronger its money will be perceived (and sought after) and vice versa. But, remember, this perception, although abstract, must somehow be backed by how well the economy can produce concrete things and services that people want.

That is why simply printing new money will not create wealth for a country. Money is created by a kind of a perpetual interaction between concrete things, our intangible desire for them, and our abstract faith in what has value: money is valuable because we want it, but we want it only because it can get us a desired product or service.

How is it Measured?

Sure, money is the $10 bill you lent to your friend the other day and don’t expect back anytime soon. But exactly how much money is out there and what forms does it take? Economists and investors ask this question everyday to see whether there is inflation ordeflation. To make money more discernible for measurement purposes, they have separated it into three categories:

M1 – This category of money includes all physical denominations of coins and currency, demand deposits, which are checking accounts and NOW accounts, and travelers’ checks. This category of money is the narrowest of the three and can be better visualized as the money used to make payments.

M2 – With broader criteria, this category adds all the money found in M1 to all time-related deposits, savings deposits, and non-institutional money-market funds. This category represents money that can be readily transferred into cash.

M3 – The broadest class of money, M3 combines all money found in the M2 definition and adds to it all large time deposits, institutional money-market funds, short-termrepurchase agreements, along with other larger liquid assets.

By adding these three categories together, we arrive at a country’s money supply, or total amount of money within an economy.

How Money is Created

Now that we’ve discussed why and how money, a representation of perceived value, is created in the economy, we need to touch on how the central bank (the Federal Reservein the U.S.) can manipulate the money supply.

Among other things, a central bank has the ability to influence the level of a country’s money supply. Let’s look at a simplified example of how this is done. If it wants to increase the amount of money in circulation, the central bank can, of course, simply print it, but as we learned, the physical bills are only a small part of the money supply.

Another way for the central bank to increase the money supply is to buy government fixed-income securities in the market. When the central bank buys these government securities, it puts money in the hands of the public. How does a central bank such as the Federal Reserve pay for this? As strange as it sounds, they simply create the money out of thin air and transfer it to those people selling the securities! To shrink the money supply, the central bank does the opposite and sells government securities. The money with which the buyer pays the central bank is essentially taken out of circulation. Keep in mind that we are generalizing in this example to keep things simple.

Conclusion

Remember, as long as people have faith in the currency, a central bank can issue more of it. But if the Fed issues too much money, the value will go down, as with anything that has a higher supply than demand. So even though technically it can create money “out of thin air,” the central bank cannot simply print money as it wants.

Definition of ‘Electronic Money’

Electronic money is money which exists only in banking computer systems and is not held in any physical form. In the United States, only a small fraction of the currency in circulation exists in physical form. The need for physical currency has declined as more and more citizens use electronic alternatives to physical currency.

In the U.S. many people receive their paychecks through direct deposit, move money with electronic fund transfers, and spend money with credit and debit cards. While physical currency still has advantages in certain situations, its role has gradually diminished. While it might seem to be a worrying thought that your bank account balance is nothing but an entry in a computer system, it is really nothing new. Fiat paper currency has no inherent worth either.

Definition of ‘Digital Money’

Any means of payment that exists purely in electronic form. Digital money is not tangible like a dollar bill or a coin. It is accounted for and transferred using computers. Digital money is exchanged using technologies such as smart phones, credit cards and the internet. It can be turned into physical money by, for example, withdrawing cash at an ATM.

Financial services companies facilitate digital money transfers and foster online transactions between complete strangers across long distances. Without digital money, many online retail websites would operate much less efficiently. Digital money also makes it possible to bank online or via smart phone, eliminating the need to use cash or to visit a bank in person.

Click On Image Above to see this video will go over Bitcoin mining and show you how to set up Bitcoin Mining Software on your computer. Bitcoin is a digital currency, which is supported by a P2P network of computers across the internet that act as servers to process the financial transactions of this currency.

Bitcoin is a digital currency created in 2009. It follows the ideas set out in a white paper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Bitcoin offers the promise of lower transaction fees than traditional online payment mechanisms and is operated by a decentralized authority, unlike government issued currencies.

There are no physical Bitcoins, only balances associated with public and private keys. These balances are kept on a public ledger, along with all Bitcoin transactions, that is verified by a massive amount of computing power.

In March 2014, the IRS stated that all virtual currencies, including Bitcoin, would be taxed as property rather than currency. Gains or losses from Bitcoin held as capital will be realized as capital gains or losses, while Bitcoin held as inventory will incur ordinary gains or losses.

The independent individuals and companies who own the governing computing power and participate in the network, also known as “miners,” are motivated by mining rewards (the release of new Bitcoin) and transaction fees paid in Bitcoin. These miners can be thought of as the decentralized authority enforcing the credibility of the Bitcoin network. New Bitcoin is being released to the miners at a fixed, but periodically declining rate, such that the total supply of Bitcoin approaches 21 million. One bitcoin is divisible to eight decimal places (100 millionth of one bitcoin), and this smallest unit is referred to as a Satoshi. If necessary, and if the participating miners accept the change, Bitcoin could eventually be made divisible to even more decimal places.

A method of trading currencies through an online brokerage account. Electronic currency trading involves converting base currency to a foreign currency at the market exchange rates through an online brokerage account.

Definition of ‘Forex – FX’

The market in which currencies are traded. The forex market is the largest, most liquid market in the world with an average traded value that exceeds $1.9 trillion per day and includes all of the currencies in the world.

There is no central marketplace for currency exchange; trade is conducted over the counter. The forex market is open 24 hours a day, five days a week and currencies are traded worldwide among the major financial centers of London, New York, Tokyo, Zürich, Frankfurt, Hong Kong, Singapore, Paris and Sydney.

The forex is the largest market in the world in terms of the total cash value traded, and any person, firm or country may participate in this market.

What is a Stock?

A deposit account held at a bank or other financial institution that provides principal security and a modest interest rate. Depending on the specific type of savings account, the account holder may not be able to write checks from the account (without incurring extra fees or expenses) and the account is likely to have a limited number of free transfers/transactions. Savings account funds are considered one of the most liquid investments outside of demand accounts and cash. In contrast to savings accounts, checking accounts allow you to write checks and use electronic debit to access your funds inside the account. Savings accounts are generally for money that you don’t intend to use for daily expenses. To open a savings account, simply go down to your local bank with proper identification and ask to open an account.

Because savings accounts almost always pay lower interest rates than Treasury bills and certificates of deposit, they should not be used for long-term holding periods. Their main advantages are liquidity and superior rates compared to checking accounts. Most modern savings accounts offer access to funds through visits to a local branch, over the internet and through automated teller machines.

What is Interest?

The amount charged, expressed as a percentage of principal, by a lender to a borrower for the use of assets. Interest rates are typically noted on an annual basis, known as the annual percentage rate (APR). The assets borrowed could include, cash, consumer goods, large assets, such as a vehicle or building. Interest is essentially a rental, or leasing charge to the borrower, for the asset’s use. In the case of a large asset, like a vehicle or building, the interest rate is sometimes known as the “lease rate”. When the borrower is a low-risk party, they will usually be charged a low interest rate; if the borrower is considered high risk, the interest rate that they are charged will be higher.

Interest is charged by lenders as compensation for the loss of the asset’s use. In the case of lending money, the lender could have invested the funds instead of lending them out. With lending a large asset, the lender may have been able to generate income from the asset should they have decided to use it themselves.

Using the simple interest formula:

Simple Interest = P (principal) x I (annual interest rate) x N (years)

Borrowing $1,000 at a 6% annual interest rate for 8 months means that you would owe $40 in interest (1000 x 6% x 8/12).

Using the compound interest formula:

Compound Interest = P (principal) x [ ( 1 + I(interest rate) N (months) ) – 1 ]

Borrowing $1,000 at a 6% annual interest rate for 8 months means that you would owe $40.70.

The interest owed when compounding is taken into consideration is higher, because interest has been charged monthly on the principal + accrued interestfrom the previous months. For shorter time frames, the calculation of interest will be similar for both methods. As the lending time increases, though, the disparity between the two types of interest calculations grows.

What is a Mutual Fund?

An investment vehicle that is made up of a pool of funds collected from many investors for the purpose of investing in securities such as stocks, bonds, money market instruments and similar assets. Mutual funds are operated by money managers, who invest the fund’s capital and attempt to produce capital gains and income for the fund’s investors. A mutual fund’s portfolio is structured and maintained to match the investment objectives stated in its prospectus.

One of the main advantages of mutual funds is that they give small investors access to professionally managed, diversified portfolios of equities, bonds and other securities, which would be quite difficult (if not impossible) to create with a small amount of capital. Each shareholder participates proportionally in the gain or loss of the fund. Mutual fund units, or shares, are issued and can typically be purchased or redeemed as needed at the fund’s current net asset value (NAV) per share, which is sometimes expressed as NAVPS.

What is an asset?

An asset is anything of value that can be converted into cash. Assets are owned by individuals, businesses and governments. Examples of assets include:

Cash and cash equivalents – certificates of deposit, checking and savings accounts, money market accounts, physical cash, Treasury bills;

Real property – land and any structure that is permanently attached to it;

Personal property – everything that you own that is not real property such as boats, collectibles, household furnishings, jewelry, vehicles;

Investments – annuities, bonds, cash value of life insurance policies, mutual funds, pensions, retirement plans (IRA, 401(k), 403(b), etc.,) stocks and other investments.

Assets are often grouped into two broad categories: liquid assets and illiquid assets. A liquid asset is one that can be converted into cash quickly with little to no effect on the price received. For example, stocks, money market instruments and government bonds are liquid assets. Illiquid assets, on the other hand, are assets that cannot be converted into cash quickly without substantial loss in value. Examples of illiquid assets include houses, antiques and other collectibles.

Your net worth is calculated by subtracting your liabilities from your assets. Essentially, your assets are everything you own, and your liabilities are everything you owe. A positive net worth indicates that your assets are greater than your liabilities; a negative net worth signifies that your liabilities exceed your assets

Definition of ‘Liability’

A company’s legal debts or obligations that arise during the course of business operations. Liabilities are settled over time through the transfer of economic benefits including money, goods or services.

Recorded on the balance sheet (right side), liabilities include loans, accounts payable, mortgages, deferred revenues and accrued expenses. Liabilities are a vital aspect of a company’s operations because they are used to finance operations and pay for large expansions. They can also make transactions between businesses more efficient. For example, the outstanding money that a company owes to its suppliers would be considered a liability.

Outside of accounting and finance this term simply refers to any money or service that is currently owed to another party. One form of liability, for example, would be the property taxes that a homeowner owes to the municipal government.

Current liabilities are debts payable within one year, while long-term liabilities are debts payable over a longer period.

What Does The Constitution Say is Money

U.S. Constitution – Article 1 Section 10

Article 1 – The Legislative Branch

Section 10 – Powers Prohibited of States

No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts; pass any Bill of Attainder, ex post facto Law, or Law impairing the Obligation of Contracts, or grant any Title of Nobility.

No State shall, without the Consent of the Congress, lay any Imposts or Duties on Imports or Exports, except what may be absolutely necessary for executing it’s inspection Laws: and the net Produce of all Duties and Imposts, laid by any State on Imports or Exports, shall be for the Use of the Treasury of the United States; and all such Laws shall be subject to the Revision and Control of the Congress.

No State shall, without the Consent of Congress, lay any duty of Tonnage, keep Troops, or Ships of War in time of Peace, enter into any Agreement or Compact with another State, or with a foreign Power, or engage in War, unless actually invaded, or in such imminent Danger as will not admit of delay.

JFK’s attempt to end the Feds in which they killed him. He wanted to eliminate the Federal Reserve Note and issue Silver Certificates instead. This order is still in effect but no one wants to enforce it because of what happen to JFK

Executive Order 11110 – Amendment of Executive Order No. 10289 as Amended, Relating to the Performance of Certain Functions Affecting the Department of the Treasury

June 4, 1963

By virtue of the authority vested in me by section 301 of title 3 of the United States Code, it is ordered as follows:

SECTION 1. Executive Order No. 10289 of September 19, 1951, as amended, is hereby further amended —

(a) By adding at the end of paragraph 1 thereof the following subparagraph (j):

“(j) The authority vested in the President by paragraph (b) of section 43 of the Act of May 12, 1933, as amended (31 U.S.C. 821 (b)), to issue silver certificates against any silver bullion, silver, or standard silver dollars in the Treasury not then held for redemption of any outstanding silver certificates, to prescribe the denominations of such silver certificates, and to coin standard silver dollars and subsidiary silver currency for their redemption,” and

(b) By revoking subparagraphs (b) and (c) of paragraph 2 thereof.

SEC. 2. The amendment made by this Order shall not affect any act done, or any right accruing or accrued or any suit or proceeding had or commenced in any civil or criminal cause prior to the date of this Order but all such liabilities shall continue and may be enforced as if said amendments had not been made.

JOHN F. KENNEDY

THE WHITE HOUSE,

June 4, 1963

The Employee Retirement Income Security Act (ERISA)

Forty years after President Gerald Ford signed the first comprehensive pension reform bill into law, the Employee Retirement Income Security Act has produced successes and failures. This is when you became an Investor and didn’t know it and not trained for it

The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for pension plans in private industry. ERISA does not require any employer to establish a pension plan. It only requires that those who establish plans must meet certain minimum standards. The law generally does not specify how much money a participant must be paid as a benefit. ERISA requires plans to regularly provide participants with information about the plan including information about plan features and funding; sets minimum standards for participation, vesting, benefit accrual and funding; requires accountability of plan fiduciaries; and gives participants the right to sue for benefits and breaches of fiduciary duty.

ERISA also guarantees payment of certain benefits through the Pension Benefit Guaranty Corporation, a federally chartered corporation, if a defined plan is terminated.

The Department of Labor’s (DOL) Employee Benefits Security Administration (EBSA) enforces ERISA

10 Financial Terms Every Investor Should Know

Breaking down investing lingo into layman’s terms is key to understanding your financial picture

For a novice, it can be intimidating to invest money. There’s the anxiety that comes with taking risks and knowing you may not get all of your money back. But arguably, what’s even more intimidating is the investing jargon. There are a lot of buzzwords financial advisors and veteran investors use, like expense ratio and asset allocation, that are important for average investors to understand, yet the language can be a barrier.

So if you’d like to invest but feel like you’re visiting another country where your money may not be welcome, maybe you just need to learn the language first. This isn’t a comprehensive list by any means, but understanding these terms may make you feel more confident about investing.

Asset allocation. This is just a fancy phrase for your investment strategy. There are three general categories where you’re going to put your money: cash, bonds and stocks, “Cash,” is the least risky and would provide the least amount of return … Bonds are generally riskier than cash but less risky than stocks.”

Cash. Since Washington brought it up, let’s define cash. It’s money – you know that – but if a financial advisor suggests you move some of your portfolio into cash, Washington says he or she is probably referring to certificates of deposit, also known as CDs, Treasury bills or money market accounts.

Bonds. When you invest in a bond, you are essentially loaning money to a company or government. Provided that nothing bad happens, like a bankruptcy, you cash in the bond on the maturity date and collect some interest.

Stocks. When you buy stock in a company, you’re purchasing a tiny bit of ownership in the firm. Generally, the better the company performs, the more your share of stock is worth. If the company doesn’t do so well, your stock may be worth less.

Mutual fund. In layman’s terms, this is a pile of money that comes from a lot of investors like you and is then invested in assets like stocks and bonds. A mutual fund may hold hundreds of stocks, with the purpose of spreading the risk. In most cases, money managers make buy and sell decisions for mutual funds, which brings us to our next definition.

Expense ratio. It costs money to run mutual funds, so investors can expect to pay an annual fee, expressed as the expense ratio. “That’s the percentage of your money that goes to the managers of the mutual fund you’re investing in” So the bigger the expense ratio, the less money you’re going to make.” The expense ratio also covers other fund expenses, such as administrative fees, record-keeping fees and even print or TV ads promoting the mutual fund. In 2013, the average stock mutual fund had an expense ratio of 1.25 percent, according to Morningstar.

Index funds. This is a popular type of mutual fund because its costs are generally low – think more like 0.2 percent. But if you really want to understand index funds, you first need to understand indexes, which are essentially collections of stocks that represent a slice of the economy. By tracking the performance of a group of stocks, indexes give investors a sense of how the stock or bond market, or a portion of it, is doing. And by investing in an index fund, you are essentially betting on the success of the basket of companies it contains.

The LADA Group Solution

The Lada Group Built by the People for the People has a SOLUTION to your CASH FLOW Problem. We have a system that will allow you to recycle dollars in your community. Starting with your cell phone contacts which is your personal community. Everybody in your contacts list pays a cell phone company on a monthly basis. How would you like to receive Weekly and Monthly payments from the same people?

The LADA Group has a solution for all of the above with 7 incomes streams all in one place contact us for more information.